Speed Shops and Retailers

Dirt Empire Magazine

Until March 30th 2026

See more

List of results (38)

Speed Shops and Retailers

Dirt Empire Magazine

Until March 30th 2026

See more

Join Our Growing Global Dealer Network

PE RACING

Until December 25th 2032

See more

Become a TSP Dealer Today!

TOP STREET PERFORMANCE

Until December 30th 2030

See more

Book a Demo by Feb. 28th and get 1 Month FREE

Pluss Software

Until February 27th 2027

See more

SHOW US YOUR ENGINE BUILD

JESEL, INC.

Until December 31st 2027

See more

Custom-Engineered Gaskets, Seals, and Converted Components

Seal Methods

Until January 4th 2030

See more

Dealer Opportunities Welcome!

CPR RACING

Until December 30th 2030

See more

Dyer's Dealers

DYERS TOP RODS, LLC

Until December 31st 2027

See more

Free Shipping on Orders Over $75

BOMBTRACK FABRICATION, LLC

Until April 1st 2029

See more

NO NEED TO WORRY ABOUT ANY POTENTIAL TARIFFS

GIANT FINISHING

Until August 6th 2030

See more

Flat Rate Shipping Now Standard!

D&J PRECISION MACHINE

Until June 23rd 2026

See more

Receive a Quote

IQ integrated Quality Inc.

Until August 29th 2030

See more

Military Discount

PACIFIC PERFORMANCE ENGINEERING

Until December 3rd 2030

See more

Check out our Used Equipment Page!

GIANT FINISHING

Until June 30th 2030

See more

Free Sample Processing

GIANT FINISHING

Until December 19th 2030

See more

5% OFF Your Next Re-Order!

RACE PART SOLUTIONS

Until July 29th 2029

See more

Got followers? Let's trade torque for gear!

STKR

Until June 15th 2027

See more

Drive Our Demo Car

GOMECSYS

Until August 31st 2028

See more

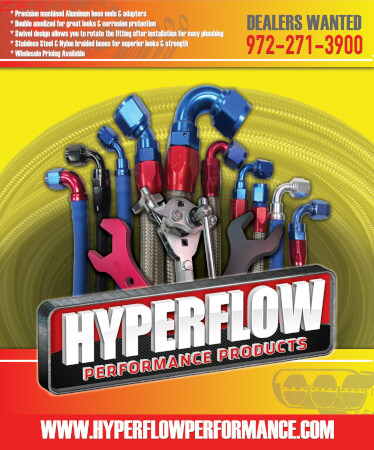

Precision Machined Aluminum Hose Ends & Adapters

HYPERFLOW PERFORMANCE PRODUCTS

Until August 31st 2026

See more

Military Discount for Active Duty and Military Veterans

D&J PRECISION MACHINE

Until October 29th 2027

See more

Don't see it? Call us

L.A.SLEEVE CO., INC.

Until December 31st 2029

See more

Tear-Offs for Racing!

VAMPIRE TEAROFFS

Until December 31st 2027

See more

Dealer Inquiries Welcome

TRIBODYN LUBRICANTS

Until December 31st 2029

See more

10% off the first order placed for New Distributors.

THERMO-TEC AUTOMOTIVE, INC.

Until June 4th 2029

See more

The Most Suitable Barrier for All Types of Circuits

TECPRO BARRIERS

Until December 31st 2027

See more